You've got your passport, packed your bags, and booked your hotels — you're ready to hit the tarmac and head out on your next international adventure. But hold up: have you purchased your international travel insurance yet?

If traveling internationally, you should approach purchasing travel insurance like booking a hotel — necessary for your safety and peace of mind.

In this article, we're digging into everything related to international travel insurance so you can buy a policy you know will give you the protection you need while overseas. So, please buckle up your seatbelt, put your tray table and seat in the upright position, and let's get into it!

In this article:

- What is international travel insurance?

- How does travel insurance work?

- Why it's important to get insurance before you travel internationally

- What does international travel insurance cover?

- Things to consider before purchasing international travel insurance

- Stay connected wherever you travel

- International travel insurance FAQs

Freepik

Freepik

What Is International Travel Insurance?

International travel insurance is a plan you purchase that protects you from various financial risks that can occur while traveling. Depending on your coverage, this could include a lost suitcase, a medical emergency, or a last-minute trip cancellation.

Most international travel insurance plans also include some form of 24/7 assistance that allows you to access advice, arrange for medical treatment, and even get a translator to serve as an interpreter.

How Does Travel Insurance Work?

While every insurance provider and plan is different, most travel insurance plans will reimburse you for any covered expenses after you file a claim and the claim is approved. You do need to pay for expenses upfront, so keep that in mind when planning.

To file a claim, you must submit proof of the expenses incurred during your travel. Most insurance providers allow you to submit your claims online, but be sure to look into the requirements for your specific plan.

Let's look at a real-world example of how international travel insurance works. You've purchased a plan that includes medical and trip cancellation insurance for your three-week trip to Italy from the United States. While you're at your first stop in Rome, you fall off your bicycle while making your way to visit the Trevi Fountain. You take an ambulance to the ER, are given a variety of tests and X-rays, and are ultimately treated for a broken wrist.

Without travel insurance, you would be responsible for covering all the costs you incurred due to the accident. Thankfully, with medical travel insurance, the insurance company would cover the trip to the ER and the cost of treatment for your broken wrist.

Once you're feeling better, you get all your receipts and bills in order and file a claim to receive your reimbursement.

Why It's Important to Get Insurance Before You Travel Internationally

If you're traveling internationally, purchasing travel insurance for the duration of your trip is extremely important. While some experts will debate the need for travel insurance when traveling in your own country, traveling internationally is always seen as a reason to insure your trip.

There are three main reasons to protect yourself with insurance that can give you peace of mind while overseas.

- Financial protection: By its very nature, international travel is expensive. Travel insurance can protect almost everything you prebook — flights, accommodations, tours, and more. Make sure you read the fine print and look for a plan that offers "trip cancellation coverage." That way, if you need to cancel your trip last minute, you won't lose all your nonrefundable deposits.

- Travel issues: While traveling overseas is exciting, there are times when it can be more of a nightmare than a dream come true. Comprehensive travel insurance can help you get through those difficult times with your sanity and wallet intact. Whether your luggage has been lost or delayed or you need assistance with an emergency translation, travel insurance can help you work through some of the most frustrating travel issues.

- Medical coverage: Maybe the most essential piece of travel insurance when it comes to peace of mind, medical coverage makes sure you're protected overseas in case of an accident or illness. When you purchase international travel insurance, you know no matter what might happen, you have emergency healthcare coverage wherever you are.

Freepik

Freepik

What Does International Travel Insurance Cover?

Every international travel insurance plan will cover different things — it's important to dot your is and cross your ts to make sure you get a plan that gives you everything you need.

Wondering what could be covered? Here are six common things that international insurance policies can cover.

Medical Insurance

Medical emergencies are stressful when you're on home soil. When they happen internationally, the mental and financial stress of the unforeseen emergency can start to pile up. You face additional barriers like different cultures, languages, customs, and climates. Plus, it's hard to ignore the financial implications of needing medical care.

But, if you opt for travel insurance, the medical insurance coverage would cover the cost of hospitalization and other medical bills if you get sick or have an accident. Some plans even offer a daily hospital cash allowance to help you take care of extra expenses while hospitalized overseas.

Emergency Dental Insurance

Emergency dental insurance covers any emergency dental work that's needed while you're traveling (note the word 'emergency!'). If you broke a tooth while enjoying a Brazil nut in Rio de Janeiro and needed immediate medical attention, your travel insurance would cover the dental bills.

Trip Cancellation Coverage

No one wants to have to cancel their vacation — it's the last thing anyone plans on doing. But it happens. And when it does, you don't want to be left with thousands of dollars in nonrefundable bookings for a trip you can't even take.

Consider this: you've been planning a trip to your favorite overseas destination for months. You've booked your flights, accommodations set, and even a few tours for when you arrive at your destination. You're three days away from leaving on a trip when you have no choice but to cancel — maybe you become ill, there's a death in the family, or the destination is expecting a weather crisis like a hurricane or volcanic eruption.

With a good travel insurance plan, the insurance company will reimburse you for all your nonrefundable, prepaid travel expenses.

Trip Interruption Coverage

Another scenario that people don't think about as much as trip cancellation is trip interruption coverage. If an emergency means you need to cut your trip short, trip interruption coverage will reimburse you for hotel reservations and other prepaid expenses. It will also cover a return flight that may need to be booked at the last minute — and we all know how pricey those last-minute flights can be.

Baggage Insurance

You get a sinking feeling when you arrive at your destination, only to learn that your luggage hasn't arrived with you. If it's delayed, you can be without your baggage for 12 hours up to a week. And if it's lost, you won't ever get it back, not to mention have nothing to wear for your trip. In both these situations, you'll need to buy new clothes, toiletries, and other essentials while you wait to find out the fate of your luggage.

This can put a strain on your travel budget. But with travel insurance, when your baggage is lost or misplaced by the airline carrier, the insurance company covers the financial loss you experience.

Evacuation Insurance

If you're traveling to a remote location, medical evacuation insurance is something you should consider. This insurance is usually offered as an add-on to a standard policy as it is something only some people need. But if you're traveling to a remote or hard-to-get-to location, add this to your plan. Suppose you have a medical emergency while hiking the Tour du Mont Blanc in France. In that case, emergency evacuation insurance will cover the cost of a helicopter evacuation if you get sick or injure yourself.

Freepik

Freepik

Things to Consider Before Purchasing International Travel Insurance

Now that you know what kind of insurance you should be looking for, there are some things to think about when you start looking for the best travel insurance policy. Above all else, make sure you find a policy that fits your needs and take the time to read through the whole policy — have we mentioned the fine print yet?

Here are a few important things to think about while researching travel insurance options.

Are There Potential Exclusions?

Check what the policy you're booking covers and what it doesn't. Don't assume that all medical expenses will be covered simply because the plan includes emergency medical coverage. Get curious and dig into that fine print. For example, some plans will cover lost luggage but won't cover expensive items like jewelry and electronics. You'll need to pack accordingly or buy additional coverage to make sure you're fully protected.

Is There a Deductible?

Like many insurance policies, some international travel insurance policies come with a deductible. A deductible is the amount you pay before the insurance plan starts to pay. While you may be comfortable with a deductible, it's important to know if there is one and how much it is.

If the deductible is US$2,000, that might be more than you can pay, in which case you'd need to look for a travel insurance plan with a lower deductible.

Does the Plan Cover Your Destination(s)?

There are some destinations that a travel insurance plan may not cover. Insurance companies typically won't cover areas with political or civil unrest or acts of war and rioting. Some plans won't cover areas when travel advisories are in place, and other insurance companies may have some destinations they choose not to cover at all times.

Is the Claims Process Straightforward?

If you have to claim your travel insurance policy, you want to know that it'll be a simple, straightforward process. Take some time before you decide which insurance provider you use to look at reviews, check out their social media, and get an idea of what the real-life claims experience has been for customers.

Stay Connected Wherever You Travel

No one wants to find themselves in an emergency, especially when they're supposed to be on holiday overseas. But it happens. International travel insurance is a great way to protect yourself in an unexpected emergency.

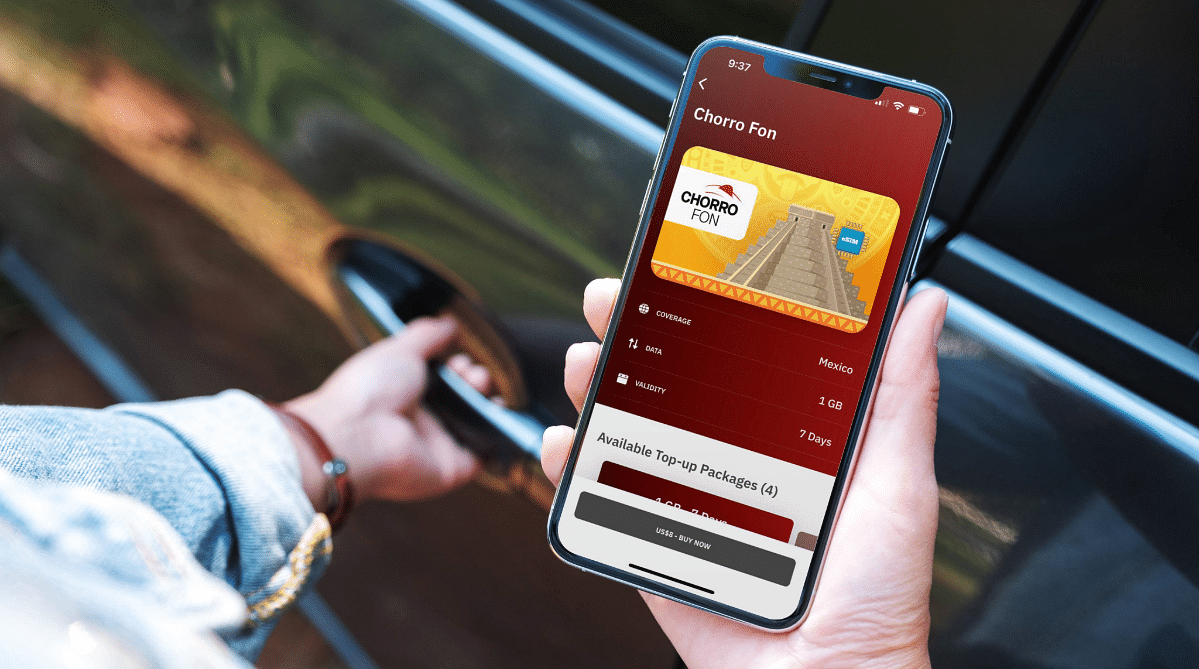

To stay protected in any situation, you need to be connected while traveling. With an eSIM from Airalo, you're connected anywhere in the world the second you can turn off airplane mode. No more huge roaming bills, dropped connectivity, or searching for a SIM vendor internationally. Just easy connections and quick access, all from your phone, thanks to Airalo.

Stay connected wherever you travel with an eSIM from Airalo.

International Travel Insurance FAQs

Is Travel Insurance Necessary for International Travel?

Most countries don't require travel insurance, but getting travel insurance when you travel overseas is in your best interest. Traveling internationally won't be covered by any health insurance or coverage from your country of origin in case of a medical emergency. Additionally, international travel is often expensive, and travel insurance protects you from trip cancellation and interruption.

Some countries require some or all travelers to have travel insurance to enter the country:

- Antarctica

- Chile

- Cuba

- Ecuador

- Egypt

- Iran

- Jordan

- Laos

- Nepal

- Qatar

- Russia

- Rwanda

- Saudi Arabia

- Schengen Countries

- Seychelles

- Turkey

- Ukraine

When is the Best Time to Buy Travel Insurance?

The best time to buy travel insurance is right after you've booked your trip. There is something called a "pre-existing condition waiver" that you want to have in place. However, insurance companies require you to purchase insurance within a set timeframe to access it. For some companies, you have 14 days from when you start booking your trip. For others, it's as little as 24 hours. So booking your insurance the same day you book flights, for example, is the best time to buy travel insurance.

How Much Does Travel Insurance Cost?

Travel insurance costs vary depending on the policy, length of your trip, and inclusion you choose. But on average, you can expect to pay 4-12% of your total trip cost. For a trip that costs US$10,000, the average travel insurance cost is about US$456.